From 8 April 2024, after numerous delays, the national collateral management systems of the Euro area national central banks will be replaced by ECMS, a single unified collateral management system for all national central banks for the management of assets used as collateral for Euro system credit operations. The ECMS will work together with the other TARGET services to ensure that cash, securities, and collateral flow freely across Europe.

We will have a closer look into the essential functions, mechanisms, and significance of the ECMS, highlighting its importance in the Euro system’s pursuit of monetary policy objectives and discussing the opportunities it provides.

Background and Evolution

Central banks play an important role in ensuring sufficient liquidity is available for financial markets. Historically, they have acted as lenders of last resort by providing distressed institutions with liquidity if needed. Until 2008, interbank liquidity was less of an issue, the cost of cash was low and market spreads were stable. However, since the financial crisis of 2008 and the European crisis in 2011, euro system liquidity has played a pivotal role for credit institutions and these shifts were reflected in policy shifts by the ECB.

At its core, the ECMS serves as the mechanism through which financial institutions pledge collateral in exchange for liquidity from the European Central Bank (ECB). The system operates on a tiered framework, with types of assets assigned to different eligibility criteria. The ECB, in collaboration with national central banks, manages this framework, ensuring that collateral eligibility criteria remain robust and adaptable to changing market conditions.

It is standard practice for the ECB to take collateral when providing liquidity, whether intraday for payment system purposes, in short-term or long-term Open Market Operations (OMO), or overnight in Standing Facilities (SF).

The ECB only provides credit against eligible collateral. The eligibility of assets is assessed by each National Central Bank (NCB) according to the criteria specified in the ECB Collateral Framework.

All Euro area countries have their own collateral management system with their own infrastructure. Each of these collateral management systems is unique and imposes its own processes and software systems on users that need to deliver collateral and obtain liquidity.

This is where the new ECMS comes into play. The ECMS is a new system that will replace the existing collateral management systems of the 19 Euro system central banks. ECMS will become the sole system used to manage both collateral and credit in Euro system credit operations.

ECMS in more detail

The relationship between the NCB and the counterparties will remain unchanged. However, from April 2024 onwards, every monetary policy counterparty needs to have a connection with ECMS if it wants to participate in refinancing operations of the Euro system and mobilise collateral. Otherwise, there will be no access to intraday credit/open market transactions or marginal lending facilities. It is therefore important that measures such as analysis of the effects, how to connect, building infrastructure and planning of ECMS connectivity are implemented in time.

Harmonisation is reached on the settlement procedures regarding the use of Triparty (Single Triparty Model, serviced by triparty agents approved by the ECB), processing of corporate actions and collection of fees.

Currently, certain settlements take place via NCBs and have a duration of days, where in the new ECMS, this will be done instantly. The ECMS converts counterparties’ instructions into settlement instructions which are sent to and settled in TARGET2-Securities (T2S)

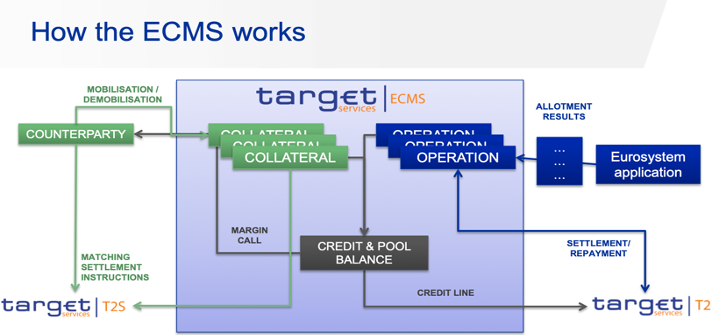

The consolidation of the technical, application and infrastructural components aims to improve the usability of the services offered to counterparties, and to ensure high security levels in line with best practices and international standards. The graph below shows how the ECMS works from the inside.

The ECMS keeps track of the individual collateral and credit positions of counterparties belonging to the Eurosystem national central banks and calculates the credit line available to each counterparty and sends this information to the central liquidity management tool (CLM).

ECMS benefits

The benefits of ECMS are multiple; below are some of the main advantages:

- Increased operational and economic efficiency through the creation of a single system for Collateral Management.

- Contribution to the financial integration and promotion of the Capital Markets Union.

- Single System for managing asset pools used as collateral in credit operations.

- One single framework with harmonization of processes and procedures.

Financial institutions are facing increasing collateral needs following the implementation of new regulatory frameworks such as mandatory clearing and the Uncleared Margin Rules (UMR). Accordingly, financial institutions are looking for solutions that allow them to:

- have a real-time, holistic and accurate view of their inventory and collateral requirements.

- assess the optimum collateral allocation based on internal and external constraints.

- manage their asset inventory.

Impact for Banks

ECMS will primarily impact banks by changing the procedures to mobilise and demobilise collateral and to request changes in credit lines. It will also result in changes to the required content and format of instructions, impose new operational deadlines and introduce of a new User Interface. All of which will require adaptations to IT systems and operational procedures. This is especially true for the mobilisation of credit claims. Market practice to mobilise credit claims currently vary greatly across different European markets.

ECMS launches in April 2024. While this is less than a year away, the critical nature of access to the central bank and the forced migration mean that preparations should already be underway. Crucially, users of ECMS will need to implement and master the workflows required to deliver collateral and request a credit line before launch.

ECMS Internal Asset Account and Collateral Pool Structure

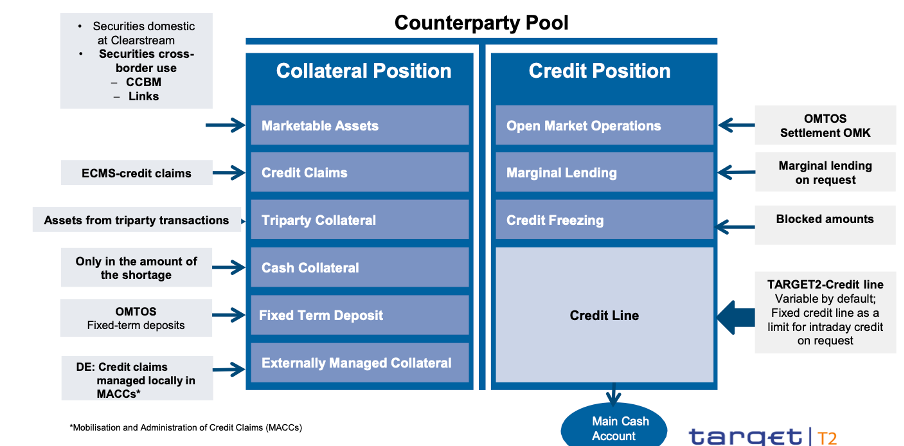

Equivalent to the current collateral account, Multi-Pooling functionality is supported, but only one pool must be used for Eurosystem credit operations. In other words, Counterparty Pool A can be used for monetary policy operations, while Counterparty Pool B can be used for other purposes.

Counterparty Asset Accounts are used to hold or mirror the counterparty collateral and are opened and managed directly in ECMS to hold the collateral positions (so-called Internal Asset Accounts). They are also kept separately by asset categories for marketable assets and ECMS credit claims. The number of accounts is determined by the NCBs and the type of collateral mobilised.

Below is a general overview of the counterparty pool and the relevant credit line.

Summary

Summary

The introduction of the new ECMS represents a significant milestone in the Eurozone’s quest for a more stable, transparent, harmonised and efficient financial ecosystem. By embracing automation, enhancing transparency, and harmonizing processes and procedures the system empowers central banks and financial institutions alike. This initiative not only strengthens the Eurozone’s financial stability but also fosters a conducive environment for innovation and market growth.

Lees de volledige serie artikelen:

1. BASEL IV: A game changer?

2. Risk-Weighted Assets: Levelling the playing field?

3. Basel IV and Clearing: A clearer picture

4. Basel IV and Securities Financing Transactions (SFT)

5. Cleared Repo: A clearer view on Repos?

6. CCP: Insights of a Master Machine

7. The Euro System Collateral Management System

8. Climate Risk, the facts and the trends

9. How to Risk Manage Climate Risk: Looking for a Crystal ball

10. XVA: X-Value Adjustment