Throughout history, the ever-changing dance of the Earth’s climate system has captivated people around the world. Today, we’re at a turning point, and the effects of climate change are becoming increasingly clear. It’s time to dive into the world of climate science and understand the deep risks our planet is facing. In this paper, we discuss the evolution and effects of climate change in the past century, political willingness, in relation to Social Development Goal 13, and its implications for financial markets. In the next article, the focus will be more on the interconnection between climate risk and risk management.

Climate risk encompasses the adverse consequences of climate change on ecosystems, societies, and economies. It extends beyond the immediate threats of extreme weather events to include long-term shifts in climate patterns that pose significant challenges to human well-being. From rising sea levels and increased frequency of hurricanes to disruptions in agriculture and water resources, climate risks are multifaceted and require comprehensive strategies to address.

The greenhouse effect has made life as we know it possible. The sun pours out intense amounts of radiation across the electromagnetic spectrum, including ultraviolet and infrared. The sun’s peak intensity is in visible light. Of the solar energy hitting the atmosphere, one-third is reflected back into space, the rest is absorbed by the earth, especially the oceans. The earth reradiates the energy it has absorbed mostly as heat in the form of infrared radiation. This process heats up the earth.

These greenhouse gases, including methane (CH4) and carbon dioxide (CO2) trap some of the reradiated heat, so they act as a blanket. During the Industrial revolution 250 years ago, CO2 levels in the atmosphere were approx. 280 parts per million (ppm). Due to human caused acceleration of CO2 gases the current CO2 levels are 400 ppm. As a result, the Earth has warmed 0.85 C since 1900 and most of this has happened since the 1970s. The major impacts of this global warming are mainly:

- Rising Sea Levels:

Historical data reveal that sea levels have fluctuated throughout Earth's history, but the current rate of sea-level rise is unprecedented. Since 1990 the sea level has risen almost 0,3 centimetres a year. Half of the rise can be explained by thermal expansion which is the process by which water warms up it takes up more space. The other half has to do with Glacier ice loss. This poses a direct threat to coastal communities and low-lying regions, leading to increased vulnerability to storm surges and flooding. - Extreme Weather Events:

Analysis of historical data demonstrates an uptick in the frequency and intensity of extreme weather events, including hurricanes, heatwaves, and wildfires. The variability in climate will increase losses due to weather events and have an economic impact on insurers. - Shifts in Ecosystems:

Historical records, coupled with contemporary observations, highlight the disruption of ecosystems due to climate change. From coral bleaching in marine environments to altered migration patterns of species, these shifts signify the vulnerability of biodiversity to changing climatic conditions. - Impacts on Agriculture:

Global warming directly makes heat waves longer, stronger and more frequent. This results in periods of drought, more wildfires and more extreme storms, which will influence agriculture in a negative manner.

One important amplifying feedback that speeds up the warming process is that when sea ice and land-based ice shrink, the white ice is replaced by blue sea or dark land whereby the latter two absorb much more solar radiation and so heats up the earth much faster. This results in even more ice melting and a decrease in overall reflectivity and leads to more warming. Another amplifying feedback is driven by water vapor. When the earth starts to heat up, evaporation increases, which puts more water vapor in the air and traps the greenhouse gases.

Political dynamics From the Kyoto Protocol to the Paris Agreement

The trajectory from the Kyoto Protocol (1997) through the Copenhagen Accord (2009) to the Paris Agreement (2015) represents a dynamic evolution in global efforts to address climate risks. The Kyoto Protocol laid the groundwork by establishing binding emission reduction targets for developed countries. However, its limitations, including the absence of commitments from major emitters like the United States and developing nations, highlighted the need for a more inclusive and comprehensive approach.

The Copenhagen Accord marked a pivotal moment in climate negotiations, introducing a shift towards voluntary pledges by both developed and developing nations. While it lacked the legal weight of the Kyoto Protocol, it set the stage for a more flexible and globally participatory framework. However, the conference was marred by challenges in reaching a universally agreed-upon treaty, revealing the complexities of aligning diverse national interests.

The Paris Agreement emerged as a watershed moment, transcending the limitations of its predecessors. With its emphasis on nationally determined contributions (NDCs), the agreement adopted a bottom-up approach, allowing each country to set its own climate targets. The overarching goal to limit global temperature rise to well below 2 degrees Celsius showcased a heightened awareness of the urgency surrounding climate risks.

Through this evolution, the international community recognised the need for a more cooperative, adaptable, and equitable response to the escalating challenges posed by climate change. The Paris Agreement, with its broad participation and commitment to transparency, reflects a collective determination to navigate the landscape of climate risks in a manner that transcends geopolitical boundaries and fosters global resilience.

Social Development Goal Climate Risk

Social Development Goal (SDG) 13 is one of the 17 goals outlined by the United Nations in the 2030 Agenda for Sustainable Development. It specifically addresses the urgent need to take action to combat climate change and its impacts. It is interconnected with various other SDGs, including those related to poverty reduction (SDG 1), clean energy (SDG 7), life below water (SDG 14), and life on land (SDG 15).

SDG 13 acknowledges that climate change is a global challenge that requires immediate and sustained action to minimize its adverse impacts on people, societies, and ecosystems. By promoting climate action, the goal aims to build resilience, reduce vulnerabilities, and mitigate the severity of climate-related events such as extreme weather, rising sea levels, and disruptions to ecosystems.

Principles for Responsible Investments (PRI)

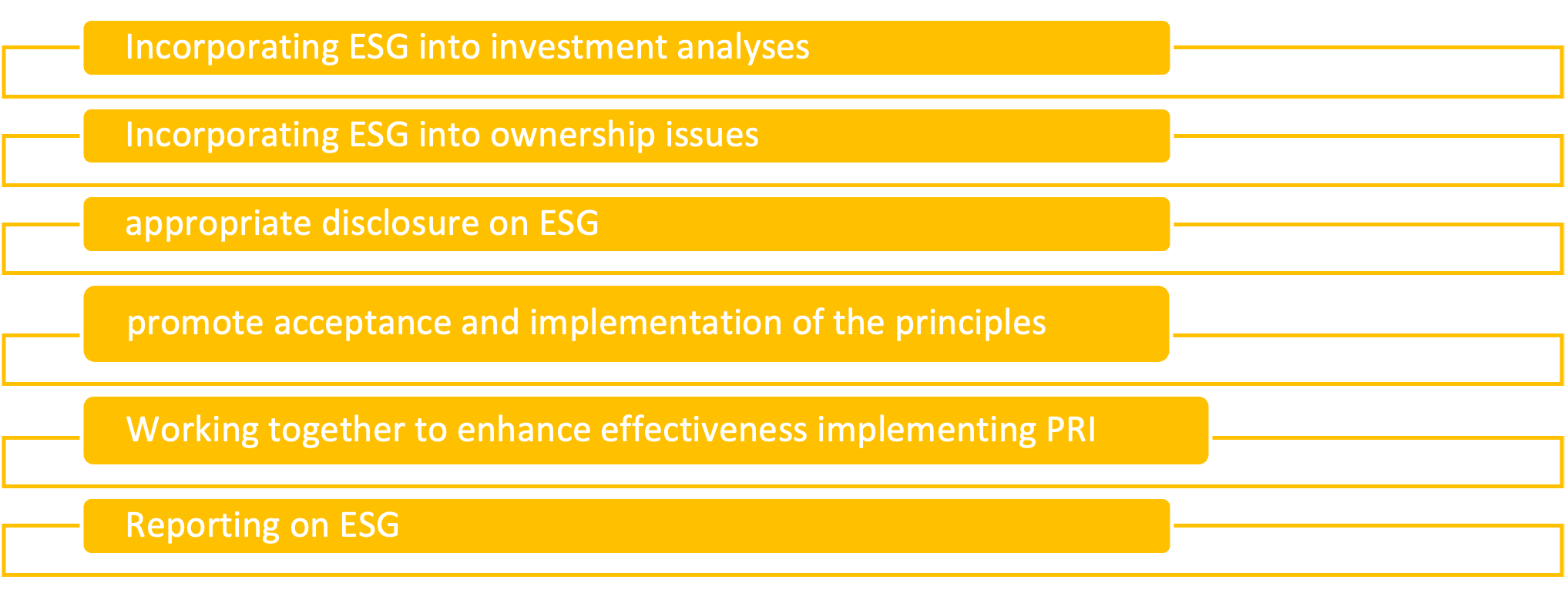

The United Nations supported PRI initiative is an international network of investors working together to put the six principles regarding PRI into practice.

PRI is a process that actively considers ESG issues within investment-making decisions and ownership practices. It requires investors to assess the full spectrum of risks and opportunities that may influence the performance of their portfolio on a long-term basis. Although it is voluntary, the growth of PRI is undeniable.

The principles are: Network of Central Banks and Supervisors for Greening the Financial System (NGFS)

Network of Central Banks and Supervisors for Greening the Financial System (NGFS)

The NGFS is a coalition of the willing; it’s a voluntary, consensus-based forum whose purpose is to share best practices, contribute to the development of climate and environment-related risk management in the financial sector and mobilise mainstream finance to support the transition towards a sustainable economy.

The impact of climate change on the economy and financial sector risk is far-reaching in breadth and magnitude, with a high degree of certainty and irreversibility and it’s questionable if economic models are adapted to this new risk. For example, are these risks fully reflected in asset valuations?

The NGFS aims to accelerate the work of central banks and Supervisors on climate risk and has published a number of recommendations like integrating climate risks into monitoring/supervision, integrating sustainability factors into own portfolio management, building awareness and intellectual capacity and consistent and robust disclosures.

Defining Green in the Financial Markets

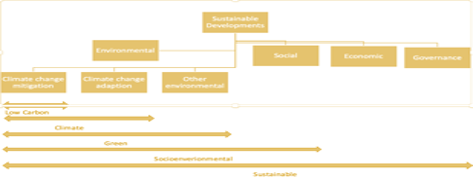

The G20 Green Finance Study Group (2016) defines “green finance” as the financing of investments that provide environmental benefits in the broader context of environmentally sustainable development. The term green is closely related to concepts such as social, climate and sustainable. The table below shows the linkages between those concepts.  The term sustainable has the broadest definition while environmental can be layered into low carbon, climate and green.

The term sustainable has the broadest definition while environmental can be layered into low carbon, climate and green.

Green Financing can also be differentiated by its means. The most prominent difference is between targeted and untargeted finance. By targeted (use of proceeds), the capital is provided for direct investments in projects via a subaccount or ringfencing. With untargeted financing, the capital is provided to companies that are environmentally friendly and there is no restriction on how the capital can be used. This is a broader approach to green investing.

According to the Green Bond Principles (GBP), “Green bonds are any type of bond instruments where the proceeds will be exclusively applied to finance or refinance new or existing eligible green projects”. The Climate Bond Initiative (CBI) has established a certification scheme for green bonds that is based on a detailed taxonomy of eligible sectors as well as exclusions.

In the Equity market, defying green is related to responsible investment. Generally, one of the following strategies will be applied:

- Screening: choice best in class companies.

- ESG integration: systematic and explicit inclusion.

- Corporate engagement and shareholder action: influence corporate behavior.

- Sustainability-themed investing: untargeted environmental technology funds.

- Impact investing: targeted investments.

Interesting facts on the State of the Market

- Europe has the highest volume of outstanding climate-aligned bonds.

- Almost 25% is AAA rated and more than 80% is investment grade.

- Water is the largest climate-aligned theme.

- Transport is top sector for allocations but it’s share is declining.

- Waste, energy and land use are still small in the bond universe but growing.

- China Railway Corporation is one of the top climate-aligned issuers.

- ABS is getting more traction as a green investment tool.

- Green sovereign bonds as a tool to raise capital to meet Paris targets.

- Green bonds tend to achieve larger book covers and spread compression during pricing when compared to vanilla equivalents.

- In the immediate secondary market after 7 and 28 days, green bonds tighten more than peers.

Trends in Climate Risks in the Financial Markets

Climate risk is a major concern for the global financial system, as it has already had a significant effect on the economy and is projected to do so in the near future. As a result, financial market participants are becoming increasingly aware of the potential risks associated with climate change. Some of the key trends in climate risk in the financial markets are:

- Increased focus on climate-related financial disclosures. Regulators and investors are increasingly demanding that companies disclose their climate-related risks and opportunities. This is helping to improve transparency and understanding of climate risk in the financial markets.

- There is a growing demand for sustainable finance products. Investors are increasingly seeking to invest in sustainable and low-carbon assets. This is driving growth in the market for green bonds, climate-focused ETFs, and other sustainable finance products.

- Development of new climate risk assessment tools and models. Financial institutions are developing new tools and models to assess climate risk in their portfolios. This is helping them to better understand and manage their exposure to climate risk.

- Increased integration of climate risk into investment decision-making. Financial institutions are increasingly integrating climate risk into their investment decision-making processes. This is helping to ensure that climate risk is adequately considered in investment decisions.

The current trends in climate risk management in the financial markets are indicative of the increasing importance of climate risk for financial market participants as the world moves towards a low-carbon economy. Ultimately, this trend indicates that financial institutions must continue to develop their capacity to effectively manage climate risk.

Summary

Climate risks are increasingly shaping trends in financial markets. Heightened awareness of environmental issues is driving a surge in demand for sustainable investments, with investors prioritizing assets that consider climate-related factors. Regulatory bodies are integrating climate risk assessments into financial regulations, influencing disclosure requirements and risk management practices.

Financial institutions are incorporating climate stress testing and scenario analysis to assess vulnerabilities. Green bonds and ESG-focused investment products are gaining prominence, reflecting a shift towards environmentally conscious financing.

As climate change intensifies, financial markets are adapting to mitigate risks, fostering a transition towards a more sustainable and resilient global economy.

Lees de volledige serie artikelen:

1. BASEL IV: A game changer?

2. Risk-Weighted Assets: Levelling the playing field?

3. Basel IV and Clearing: A clearer picture

4. Basel IV and Securities Financing Transactions (SFT)

5. Cleared Repo: A clearer view on Repos?

6. CCP: Insights of a Master Machine

7. The Euro System Collateral Management System

8. Climate Risk, the facts and the trends

9. How to Risk Manage Climate Risk: Looking for a Crystal ball

10. XVA: X-Value Adjustment