Clearing Over-the-Counter (OTC) derivatives has been a focal point for financial regulatory reforms in recent years. The 2008 global financial crisis exposed the vulnerabilities associated with these complex and opaque financial instruments, leading to increased scrutiny and the implementation of clearing mandates. Especially for smaller banks the new rules require an upscale in risk management activities and reporting requirements.

Clients will be affected directly by the difference in cost bases for bilateral vs cleared OTC derivatives. So, for clients it will be crucially important to understand the consequences of clearing and Basel IV.

We will discuss the differences between cleared and non-cleared as well as the threats and opportunities for end-users. Finally, we will discuss the RWA discussion for non-rated corporates and the impact on clients.

Bilateral vs Clearing

OTC derivatives are privately negotiated contracts between two parties, typically involving complex financial instruments such as swaps, forwards, options, and more. As these contracts are privately negotiated, they lack the standardized terms and centralized clearinghouses seen in exchange-traded derivatives. Instead, bilateral OTC derivatives offer greater flexibility in contract design, allowing parties to tailor agreements to their specific needs. This flexibility is particularly beneficial for large, customized transactions that may not be readily available on exchange-traded markets.

However, the flexibility of bilateral OTC derivatives comes with some inherent risks. The lack of transparency and standardization may lead to discrepancies in pricing and valuation methods, potentially increasing counterparty risk. Furthermore, the absence of a central clearinghouse means that in the event of a counterparty default, the non-defaulting party may face challenges in recovering their losses promptly.

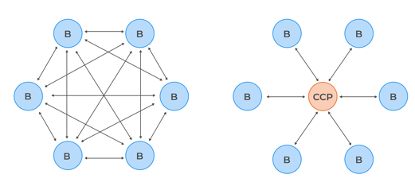

Clearing, on the other hand, involves the use of central clearinghouses, which act as intermediaries between the two parties in a derivative contract. When parties engage in cleared derivatives, they are required to submit their trades to the clearinghouse, which then becomes the central counterparty to both sides of the transaction. This process ensures that each party's obligations are guaranteed by the clearinghouse, reducing counterparty risk significantly. See figure below for the main difference between cleared and bilateral.

Bilateral vs. cleared

Bilateral vs. cleared

One of the primary benefits of clearing is the mitigation of systemic risk. By centralizing and standardizing the products and processes, regulators can monitor and manage potential risks more effectively. Additionally, clearinghouses impose standardized margin requirements, reducing the potential for excessive leverage and enhancing market stability and transparency. We will further elaborate on margin requirements and CCPs in general in the coming weeks in new articles.

Cleared versus Non-cleared Derivatives:

Threats and Opportunities

For clients there will be threats as well as opportunities with the new regulations. This will have an impact on business cases, economic viability, and legal obligations (mandatory vs voluntary). We will discuss the threats and opportunities.

Threats for (non) Financial Institutions:

- Complexity: Clearing complex financial instruments requires sophisticated infrastructure and technology. Ensuring the capability to handle such complexity can be resource-intensive with long timelines for implementation.

- Compliance Costs: Implementing Basel IV and clearing may impose significant compliance costs, particularly for smaller players.

- Data and Reporting Requirements: The success of clearing depends on accurate data collection and reporting, which can be complex and demanding.

- Collateral Requirements: CCPs typically require participants to post collateral to cover potential losses. Meeting these collateral requirements can be challenging. This will be discussed in upcoming articles.

- Regulatory Coordination: Clearing mandates often involve multiple jurisdictions, necessitating coordination among different regulatory authorities. Harmonizing rules and regulations across borders can be complex and time-consuming.

- Liquidity and Pricing: The concentration of derivatives within CCPs may impact market liquidity, and the pricing of these instruments can be influenced by clearing costs.

The upcoming implementation of Basel IV will undoubtedly have an effect, particularly in regards to pricing, liquidity, and collateral management. However, it is important to also take into account the potential impact on operational risk. A robust risk framework and operational/IT infrastructure must be in place to adhere to all compliance and regulatory rules for end-users.

Fortunately, there are also some opportunities with clearing:

- Improved pricing for OTC derivatives. Counterparty credit risk will decrease through a reduction in RWA.

- Portability: portfolio can be easily transferred in case of financial instability.

- Liquidity: less fragmentation and more standardization induce more liquidity.

- Transparency: reporting and compliance are standardized.

- Portfolio & Cross product margining: margin requirements can be decreased and therefore indirectly reducing liquidity costs.

- Netting: simplified position management, compression and reduction of leverage on the balance sheet => reduction of capital.

The most important drivers for the cost of clearing are capital and liquidity and lowering these drivers will have a positive impact on the cost of trading. For end-users it’s important to take this cost into consideration directly as well as indirectly when calculating their business cases.

Basel IV and RWA for centrally cleared vs non-centrally cleared

The Basel IV capital requirements for OTC derivatives are significantly higher for non-centrally cleared derivatives than for centrally cleared derivatives. For centrally cleared derivaties, a RWA of 2 to 4% applies instead of the minimum of 20% for non-centrally cleared.

The higher capital requirements for non-centrally cleared derivatives create a strong incentive for market participants to clear their OTC derivatives through CCPs. This is because clearing through a CCP can help reduce the amount of capital that a bank needs to hold.

In addition to the higher capital requirements, Basel IV also introduces new margining requirements for non-centrally cleared derivatives. This means that market participants will need to post more collateral when trading non-centrally cleared derivatives. This can also be a significant cost for market participants.

Counterparty risk weight potentially moving to fourfold with bilateral OTC derivatives?

Under Basel IV it is no longer possible to use the Advanced IRB (A-IRB) for lending to larger corporates and institutions. They will instead have to use the Foundation IRB approach (F-IRB). In the F-IRB only the Probability of Default (PD) factor can be determined internally by the bank, all other factors are predetermined, this is not the case in the A-IRB. This means that for the IRB approach the risk weight will be higher.

In the standardized approach (SA), lending to all unrated corporates (above SME size) under Basel IV will attract a 100% risk weight when calculating a bank's risk-weighted assets, regardless of the real credit quality of the corporate.

So, the new rules require banks that use the IRB approach to hold capital equal to at least 72.5% of the amount indicated by the standardized model (output floor), regardless of what their internal model suggests. This will increase the RWA banks use for the pricing of bilateral derivatives and indirectly affect the cost base for clients.

Clients who make use of banks regarding OTC derivatives should consider making use of clearing in the near future as it will probably diminish their cost base. However, they have to first consider which products and counterparties are in scope and have a clear view of what their TOM will look like.

Conclusion

Basel IV and clearing have the potential to significantly impact the OTC derivatives market. For clients, there are both threats and opportunities associated with these changes. The clearing of OTC derivatives through CCPs is a complex issue with both benefits and drawbacks. The Basel IV capital requirements and margining requirements are likely to increase the amount of OTC derivatives that are cleared through CCPs. However, there are also some potential risks associated with the clearing of OTC derivatives through CCPs. These risks need to be carefully considered before making any decisions about the future of OTC derivatives markets. Market participants should review their business cases and adjust their portfolios to the new regulation.

Lees de volledige serie artikelen:

1. BASEL IV: A game changer?

2. Risk-Weighted Assets: Levelling the playing field?

3. Basel IV and Clearing: A clearer picture

4. Basel IV and Securities Financing Transactions (SFT)

5. Cleared Repo: A clearer view on Repos?

6. CCP: Insights of a Master Machine

7. The Euro System Collateral Management System

8. Climate Risk, the facts and the trends

9. How to Risk Manage Climate Risk: Looking for a Crystal ball

10. XVA: X-Value Adjustment