This article covers a brief introduction to BASEL IV and the consequences for banks.

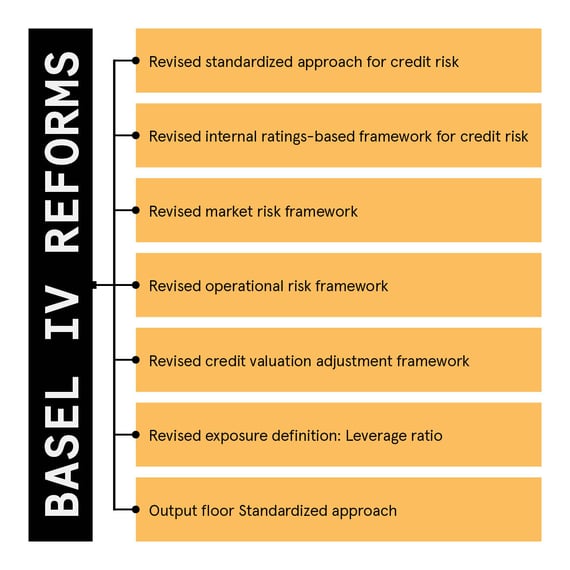

In December 2017 the Basel Committee published a revised set of minimum standards for the capital treatment of credit risk, operational risk and credit valuation adjustment risk, and for a new output floor to limit the extent to which banks will be able to use internal models for credit and market risk to drive down capital requirements. The Basel IV reforms are planned to be incorporated in European law through in the CRR III[1] and CRD IV[2] in 2025 (see table 1).

Impact on Banks include:

The new regulations will have a direct impact on the cost base of banks. These costs will be passed through to customers and will in general lead to an increase in cost. Below are some of the most important changes of Basel IV, which can impact the pricing of product and services.

- Standardized Approach for Credit Risk: Basel IV introduces stricter rules for calculating credit risk under the standardized approach. It requires banks to assign higher risk weights to certain assets, such as residential mortgages, commercial real estate, and sovereign exposures.

- Internal Model Approach: Basel IV introduces revisions to the Internal Ratings-Based (IRB) approach, which allows banks to use their internal models for calculating credit risk. The changes aim to reduce variability in risk-weighted assets (RWAs) and enhance comparability between banks that rely on models.

- Operational Risk: Basel IV introduces a new standardized approach for calculating operational risk capital requirements, replacing the existing approaches. It seeks to make the capital requirements more risk-sensitive and aligned with banks' operational risk profiles.

- Market Risk: Basel IV revises the market risk framework, introducing more risk-sensitive measures for banks' trading books and distinction between trading and banking book.

- Output Floor: Basel IV sets a minimum level, known as an output floor, for calculating regulatory capital requirements. This floor limits the extent to which banks' capital requirements can be lower than what they would be under the standardized approach. The purpose is to ensure consistency and prevent excessive variation in capital calculations across banks.

What are the impacts of Basel IV?

The impact of Basel IV on banks will vary depending on the size and complexity of the bank. However, in general, banks can expect to see an increase in their capital requirements, a change in their risk-weighting approaches, and a strengthening of their liquidity requirements.

This will lead indirectly to a change in pricing of product and services for their customers.

The increase in capital requirements will be the most significant impact of Basel IV for banks. Banks will need to hold more capital to cover their risks, which will increase their costs. This could lead to banks reducing their lending or increasing their fees.

The change in risk-weighting approaches will also have an impact on banks. Banks will need to use new methods to calculate the risk-weights of their assets, which could lead to some assets being reclassified as riskier. This could increase the capital requirements for some banks.

A bank's clients will be indirectly affected by Basel IV and will be required to analyze their product and service allocation, and this in itself will lead to changes in the risk return profile.

Opportunities?

The shift from Basel III to Basel IV standards is a significant overhaul of banking systems and processes and with less than two years to the January 2025 implementation timeline, financial institutions have plenty to consider. Financial institutions have traditionally approached risk management and regulatory reporting independently.

The move to Basel IV is an opportunity for banks to consider building an enterprise view of all internal and regulatory metrics, across risk types and Pillar 1, 2 and 3. Such an approach while optimizing banking resources, enables stakeholders to meet management and regulatory compliance without a negative impact on business cases expectations.

As a client you need to be in control of all the new Basel IV regulations, compliance and think about the consequences it will have on your business allocation. This can have a severe impact on your risk return profile.

Lees de volledige serie artikelen:

1. BASEL IV: A game changer?

2. Risk-Weighted Assets: Levelling the playing field?

3. Basel IV and Clearing: A clearer picture

4. Basel IV and Securities Financing Transactions (SFT)

5. Cleared Repo: A clearer view on Repos?

6. CCP: Insights of a Master Machine

7. The Euro System Collateral Management System

8. Climate Risk, the facts and the trends

9. How to Risk Manage Climate Risk: Looking for a Crystal ball

10. XVA: X-Value Adjustment